Defining the Purpose and Scope of a US Sovereign Wealth Fund

A Plan for Establishing a United States Sovereign Wealth Fund – Establishing a United States Sovereign Wealth Fund (US SWF) presents a significant opportunity to address pressing economic challenges and secure long-term prosperity. This section will Artikel the potential economic goals, specific objectives, and legal framework for such a fund, drawing comparisons with international models.

Potential Economic Goals and Objectives of a US SWF

A US SWF could serve multiple economic goals, including bolstering infrastructure development, reducing national debt, and enhancing retirement security. Infrastructure investment, a key objective, would focus on modernizing transportation, energy grids, and communication networks, stimulating economic growth and creating jobs. Debt reduction would involve using SWF earnings to retire existing government debt, freeing up budget resources for other priorities. Finally, enhancing retirement security could be achieved by strategically allocating SWF assets to support existing retirement programs or establish new, supplementary schemes.

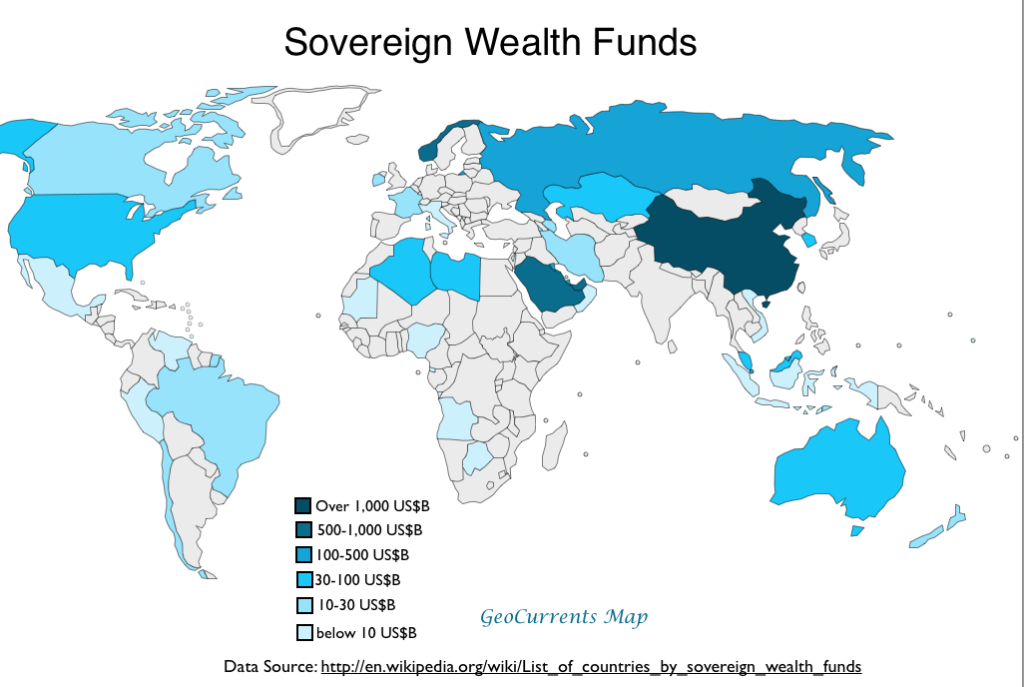

Comparison of Sovereign Wealth Fund Models

Various countries operate SWFs with differing mandates and investment strategies. The Norwegian Government Pension Fund Global, for example, focuses on long-term, diversified investments, prioritizing sustainability and ethical considerations. In contrast, some SWFs, like those in the Middle East, are more directly tied to national resource revenues and may adopt higher-risk investment strategies. Analyzing these diverse models helps inform the optimal design of a US SWF, balancing risk tolerance with long-term objectives. Strengths of diversified models include resilience to market fluctuations, while weaknesses of highly concentrated models include vulnerability to specific sector downturns. A US SWF should aim to adopt the strengths while mitigating the weaknesses observed in existing models.

Legal and Regulatory Framework

Establishing a robust legal and regulatory framework is crucial for the successful operation of a US SWF. This framework must define the fund’s governance structure, investment mandates, and accountability mechanisms. Clear legal provisions are needed to address issues such as conflict of interest, transparency, and public reporting. The framework should be designed to ensure the fund operates independently from political influence, promoting long-term stability and preventing misuse of public funds. Independent oversight bodies, robust auditing processes, and transparent reporting mechanisms are essential components of this framework.

Funding Mechanisms for the Sovereign Wealth Fund

Securing sufficient and sustainable funding is paramount to the success of any SWF. This section explores various funding mechanisms, evaluating their pros and cons and proposing a system for ongoing contributions.

Methods for Initial Capital and Ongoing Contributions

Several avenues exist for funding the initial capital of a US SWF. These include allocating a portion of the federal budget, utilizing proceeds from asset privatization (e.g., selling government-owned enterprises), and leveraging revenues from natural resources (where applicable). Ongoing contributions could be secured through a dedicated tax or levy, a percentage of federal revenues, or a combination of these approaches. Each method presents trade-offs: budget allocation might strain other government programs, privatization could face political resistance, and reliance on natural resource revenues introduces volatility. A balanced approach, possibly combining budget allocation with a dedicated revenue stream, might be the most prudent strategy.

Managing Funding Fluctuations

Fluctuations in funding sources are inevitable. A robust strategy should incorporate mechanisms to mitigate the impact of these fluctuations. This could involve creating a reserve fund to absorb short-term downturns, diversifying funding sources, and establishing a flexible investment strategy that can adapt to varying levels of capital inflow. Regular reviews of the funding mechanism and adjustments as needed will ensure the long-term sustainability of the fund.

Investment Strategies and Risk Management

A comprehensive investment strategy is essential for maximizing returns while minimizing risk. This section details asset allocation, risk management, and potential investment opportunities.

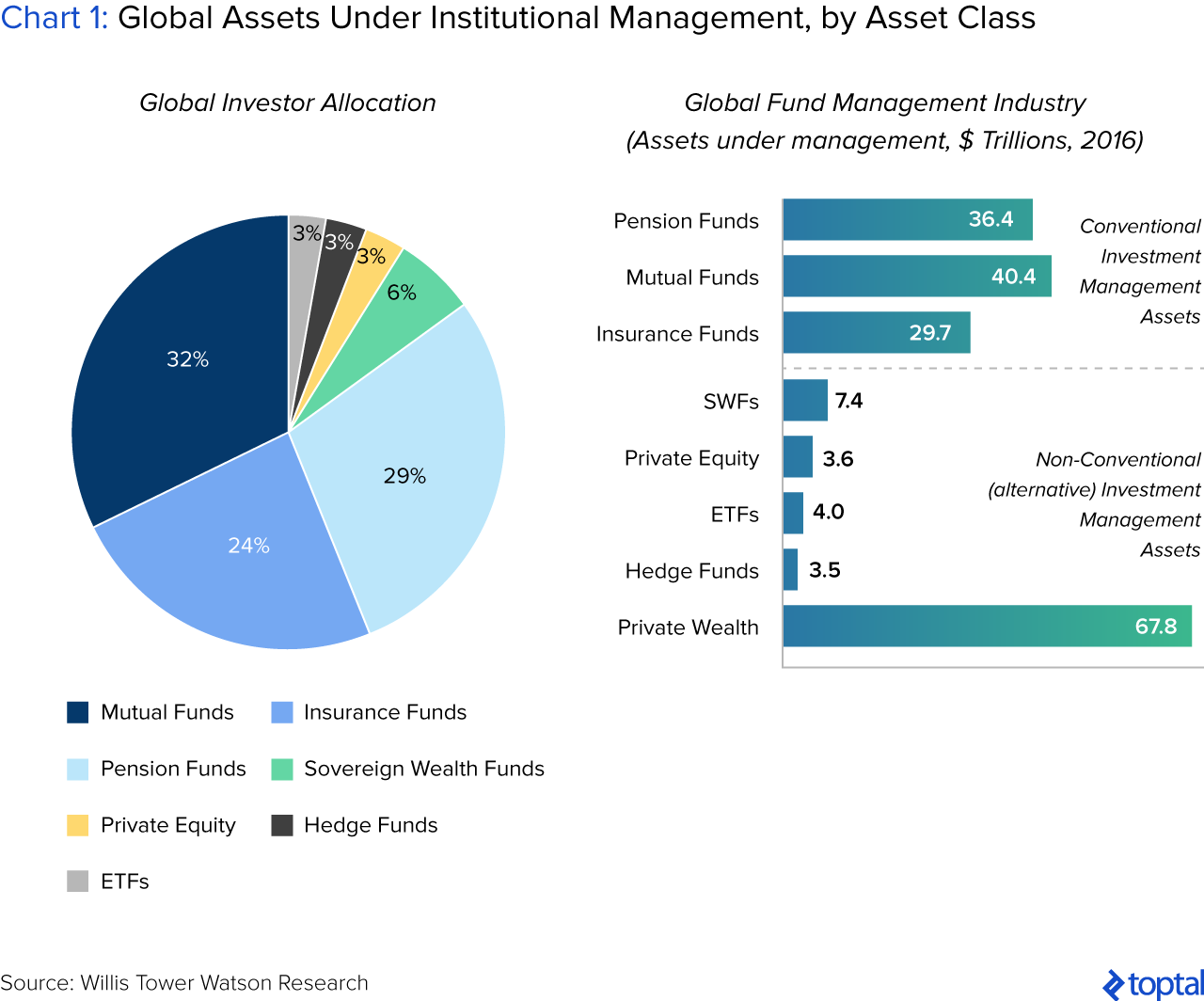

Asset Allocation and Investment Approaches

The US SWF should adopt a diversified investment strategy, allocating assets across various asset classes, including equities, bonds, real estate, and private equity. The specific allocation will depend on factors such as risk tolerance, return objectives, and the fund’s time horizon. A long-term horizon allows for a more aggressive allocation towards higher-growth, higher-risk assets, while a shorter horizon may necessitate a more conservative approach. A mix of active and passive investment management strategies can be employed to optimize returns and manage risk effectively.

Risk Management Framework

A robust risk management framework is crucial to safeguard the fund’s assets. This framework should incorporate measures to mitigate various risks, including market risk, credit risk, operational risk, and geopolitical risk. Regular stress testing, scenario analysis, and independent risk assessments should be conducted to identify and address potential vulnerabilities. Clear risk tolerance limits and investment guidelines should be established and adhered to rigorously.

Potential Investment Opportunities and Associated Risks

| Investment Type | Expected Return | Risk Level | Investment Strategy |

|---|---|---|---|

| US Infrastructure Projects | Moderate to High | Moderate | Long-term, diversified portfolio approach |

| Global Equities | Moderate to High | High | Diversified portfolio across sectors and geographies |

| US Treasury Bonds | Low to Moderate | Low | Strategic allocation for stability and liquidity |

| Renewable Energy Projects | Moderate to High | Moderate | Focus on long-term growth and sustainability |

Governance and Transparency

Establishing a transparent and accountable governance structure is critical for maintaining public trust and ensuring the responsible management of public funds. This section Artikels a proposed governance structure and mechanisms for ensuring transparency.

Governance Structure and Stakeholder Roles

The US SWF should be governed by an independent board of directors, comprised of experts in finance, economics, and public policy. The board would oversee the fund’s management team, ensuring adherence to investment strategies and risk management guidelines. Independent oversight bodies, such as a government audit agency, would provide additional scrutiny and accountability. Clear lines of responsibility and decision-making processes should be established to prevent conflicts of interest and ensure efficient operations.

Transparency and Accountability Mechanisms, A Plan for Establishing a United States Sovereign Wealth Fund

Transparency is essential for maintaining public trust. The fund’s investment decisions, performance data, and financial statements should be publicly disclosed in a timely and comprehensive manner. Independent audits should be conducted regularly, and the results made publicly available. A robust whistleblower protection program would encourage the reporting of any irregularities or misconduct.

Preventing Conflicts of Interest and Promoting Ethical Conduct

Strict conflict-of-interest policies should be implemented, prohibiting board members and management from engaging in activities that could compromise the fund’s interests. A code of ethics should be established, outlining acceptable conduct and providing guidance on ethical dilemmas. Regular ethics training should be provided to all fund employees.

Public Reporting and Disclosure

Comprehensive annual reports should be prepared and disseminated to the public, detailing the fund’s investment performance, financial position, and governance activities. These reports should be accessible and easy to understand, promoting transparency and accountability. Regular updates on the fund’s progress should be provided through press releases and public forums.

Potential Societal Impacts and Distributional Effects: A Plan For Establishing A United States Sovereign Wealth Fund

The establishment of a US SWF will have far-reaching societal impacts, affecting various segments of the population differently. This section analyzes potential positive and negative consequences and explores the distributional effects of the fund’s investments.

Economic Consequences and Impacts on Income Inequality

A well-managed SWF can generate substantial economic benefits, including increased infrastructure investment, job creation, and higher returns on public funds. However, there’s a risk that the benefits may not be evenly distributed across all socioeconomic groups. For instance, investments in infrastructure projects might disproportionately benefit certain regions or communities, potentially exacerbating existing inequalities. Careful consideration should be given to the fund’s investment strategy to ensure that it promotes inclusive growth and reduces income inequality. Targeted investments in underserved communities and initiatives to support small and medium-sized enterprises (SMEs) could help mitigate these risks.

Promoting Social Goals through Investment Strategies

The SWF’s investment strategy can be designed to promote various social goals, including environmental sustainability, affordable housing, and access to healthcare. For example, investments in renewable energy projects can contribute to reducing carbon emissions and promoting a cleaner environment. Investments in affordable housing initiatives can address the housing shortage and improve living conditions for low-income families. The fund could also invest in companies committed to ethical labor practices and sustainable development.

Illustrative Depiction of Distributional Effects

Imagine a graph showing the distribution of benefits from SWF investments across different income brackets. A successful, equitable SWF would demonstrate a relatively even distribution, with significant benefits accruing to lower and middle-income brackets through job creation in infrastructure projects, for instance, or increased returns on retirement programs. Conversely, a poorly designed or managed SWF might show a disproportionate concentration of benefits in higher-income brackets, leading to increased income inequality. Careful planning and a focus on inclusive growth are crucial to achieving a more equitable distribution of benefits.