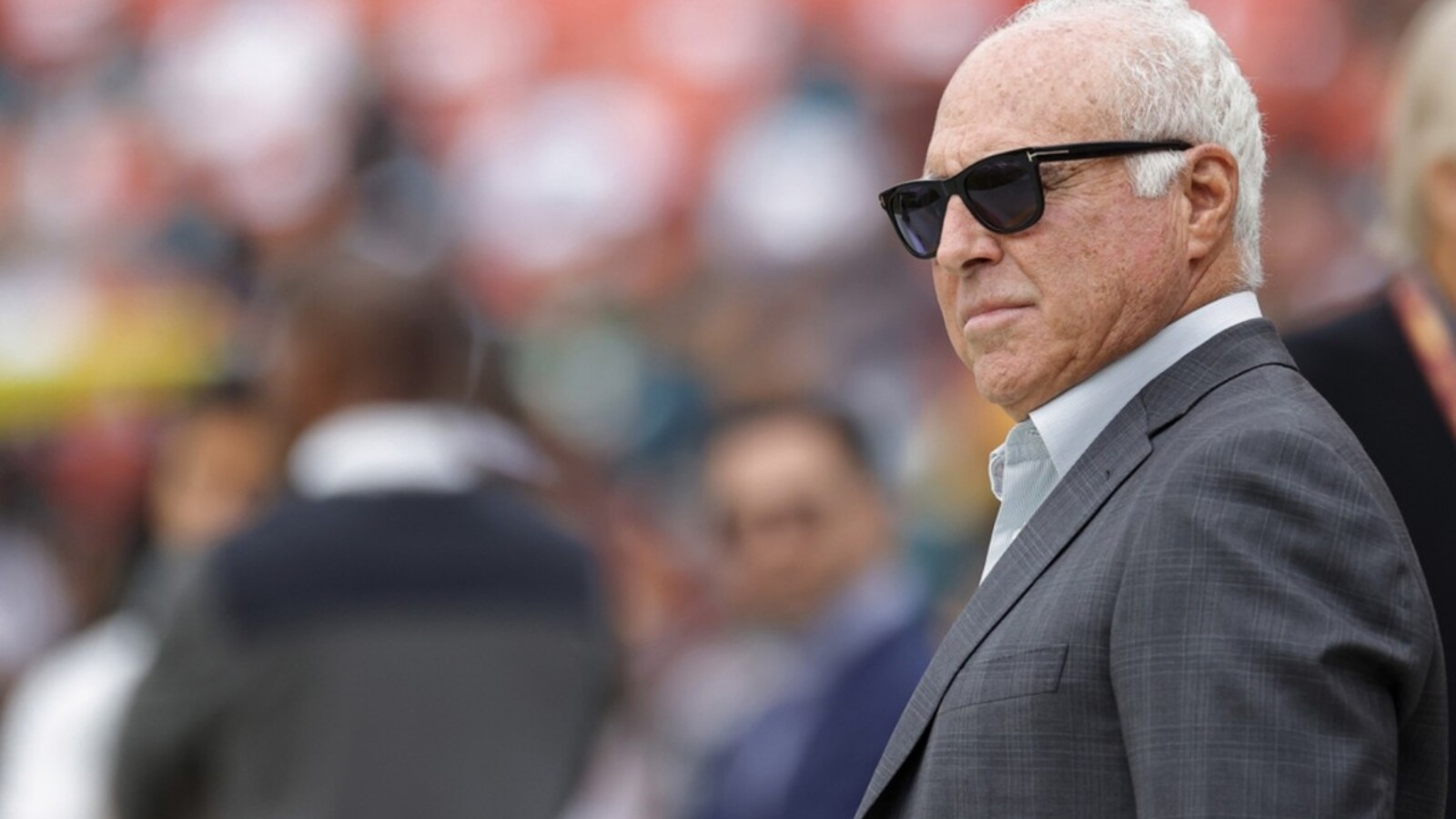

Jeffrey Lurie’s Disinterest in Acquiring the Boston Celtics: Eagles CEO Jeffrey Lurie Not Interested In Buying Celtics

Eagles CEO Jeffrey Lurie not interested in buying Celtics – Recent speculation linking Philadelphia Eagles owner Jeffrey Lurie to a potential purchase of the Boston Celtics has been met with a lack of confirmation from Lurie himself. This article delves into Lurie’s business portfolio, the Celtics’ ownership structure, and the various factors that make a Celtics acquisition unlikely, exploring alternative investment avenues for Lurie and the potential implications for both the Eagles and the Celtics.

Jeffrey Lurie’s Business Portfolio and Investment Strategy, Eagles CEO Jeffrey Lurie not interested in buying Celtics

Beyond his ownership of the Philadelphia Eagles, Jeffrey Lurie’s business interests are diverse. He has investments in film production, real estate, and other ventures. His investment strategy appears to prioritize long-term growth and stability, often focusing on assets with established value and potential for appreciation. Comparing this to a potential Celtics acquisition, Lurie’s past decisions suggest a preference for calculated risks, favoring opportunities with a clear path to profitability and manageable financial burdens. A major sports franchise purchase, however, presents a significantly higher financial commitment and a greater level of risk compared to his typical investments. The financial constraints on such a large purchase would likely be substantial, considering the current valuation of the Celtics and the significant capital expenditure required for maintaining and improving the franchise.

A hypothetical financial model for acquiring the Celtics would need to account for the purchase price (likely in the billions), ongoing operational costs (player salaries, stadium maintenance, administrative expenses), and potential debt financing. Even with Lurie’s considerable wealth, the sheer scale of this undertaking would necessitate significant financial planning and likely involve leveraging existing assets or securing substantial external financing, creating potential financial vulnerabilities.

The Boston Celtics’ Ownership Structure and Valuation

The Boston Celtics’ ownership structure is complex, involving multiple partners. Determining the exact ownership breakdown is difficult due to the private nature of the ownership group. The potential sale price of the Celtics is heavily influenced by factors such as the team’s performance, the current NBA market value, and the overall economic climate. While the exact sale price remains speculative, given recent sales of other major sports franchises, it’s reasonable to assume a valuation in the billions of dollars. While there have been reports of various interested parties, no concrete information has emerged about specific bidders beyond the realm of speculation.

Compared to other major sports franchises like the NFL’s Dallas Cowboys or the MLB’s New York Yankees, the Celtics hold a strong market position, but their valuation is influenced by factors unique to the NBA. The franchise’s consistent success, fanbase, and market presence in Boston contribute to a high valuation, but the complexities of the NBA’s revenue sharing model and the potential for player salary fluctuations introduce uncertainty into the overall valuation.

Speculation and Media Coverage of the Potential Purchase

Numerous media outlets have reported on the possibility of Lurie acquiring the Celtics, often fueled by speculation and lacking direct confirmation. The motivations behind these reports are varied, ranging from generating interest and clicks to reflecting on broader trends in sports ownership. The impact on public perception has been a mixture of excitement among Celtics fans and some skepticism given the lack of official confirmation.

A timeline of significant news articles and statements related to this topic would reveal a pattern of initial speculation followed by a period of limited confirmation and finally a gradual decrease in media coverage as the likelihood of the acquisition diminished. The narrative has largely shifted from an initial flurry of speculation to a more realistic assessment of the situation, highlighting the challenges and financial hurdles associated with such a significant acquisition.

Alternative Investment Opportunities for Jeffrey Lurie

Beyond the Celtics, Lurie has several alternative investment opportunities in the sports and entertainment industries. These could include investing in smaller sports franchises, media companies, or technology ventures related to sports. A comparison of the risks and rewards of investing in the Celtics versus these other options would reveal a higher risk-reward profile for the Celtics acquisition due to its massive capital outlay and potential for substantial financial loss.

Other significant acquisitions or investments made by owners of NFL teams include investments in other sports teams, entertainment companies, and technology firms. These decisions often reflect diversification strategies, aiming to spread risk and generate returns across multiple sectors.

| Investment | Potential ROI (High/Medium/Low) | Risk Level (High/Medium/Low) | Liquidity |

|---|---|---|---|

| Boston Celtics | Medium | High | Low |

| Smaller Sports Franchise | Medium | Medium | Medium |

| Sports Media Company | Medium | Medium | Medium |

Impact of a Potential Celtics Acquisition on the Philadelphia Eagles

Acquiring the Celtics would have both positive and negative impacts on the Philadelphia Eagles. Positive impacts could include increased brand recognition and diversification of revenue streams. However, negative impacts could include potential conflicts of interest, resource allocation challenges, and a dilution of management focus on the Eagles. The implications for brand image and fan loyalty for both franchises are complex, with potential for both positive synergy and negative backlash depending on Lurie’s management approach.

A hypothetical scenario outlining how Lurie would manage both organizations simultaneously would require a robust organizational structure with clear lines of authority and delegated responsibilities to avoid conflicts and ensure efficient operation of both franchises. This would likely involve appointing experienced executives to oversee day-to-day operations of each team, allowing Lurie to focus on strategic decision-making.

Lurie’s Public Statements and Actions Regarding the Celtics

To date, there have been no direct quotes from Lurie confirming any interest in purchasing the Celtics. His public actions and statements, focusing primarily on the Eagles, suggest his investment priorities remain centered on his existing NFL franchise. Any statements made by Lurie’s representatives have largely been non-committal, reflecting a cautious approach to speculation and a prioritization of maintaining focus on the Eagles’ performance and operations.

A summary of Lurie’s known public appearances and statements related to this topic reveals a consistent pattern of avoiding direct comment on the Celtics acquisition rumors, instead emphasizing his commitment to the Philadelphia Eagles and his broader business interests.